It is commonly said that getting a merchant account is easy, as the processing companies will be gaining from you. But that's not the case. The payment business is highly competitive and the processing companies want your business, but they still have to follow the rules.

The payment industry is not that easy as it seems. There are a lot of terms that are used like merchant accounts, payment processor, and payment gateway. You can buy an efficient credit card payment machine for your business via https://www.cutpay.co.uk/fixed-terminals.

These terms will be discussed below which would give you a basic idea of how the whole process works.

A merchant account is a bank account that is used for keeping the money generated by using credit or debit cards. Transactions that take place with a credit or debit card go to your merchant account and from there it is transferred to your business account. This normally is done on a daily or weekly basis.

If you are planning to accept MasterCard or Visa as payments online, you will require a merchant account provider that gives out merchant accounts to e-commerce businesses. A merchant account is a legally authorized agreement between you (business) and the provider.

It is not a difficult term to understand it means when a customer makes a transaction through a credit card, their information is sent to the MasterCard or Visa server, from where it collects the data regarding the funds available on his card.

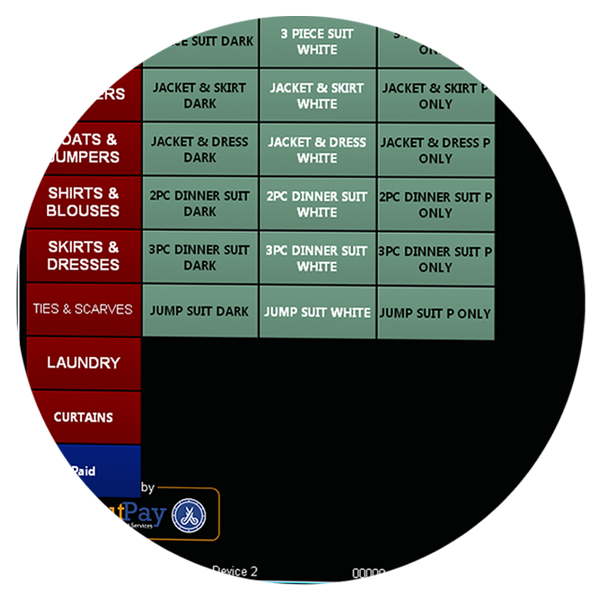

So, if your business accepts credit cards, then it is required that you make the transactions through the point of sale system or a POS machine, which acts as a payment gateway.